Bakken Strategy

Operations

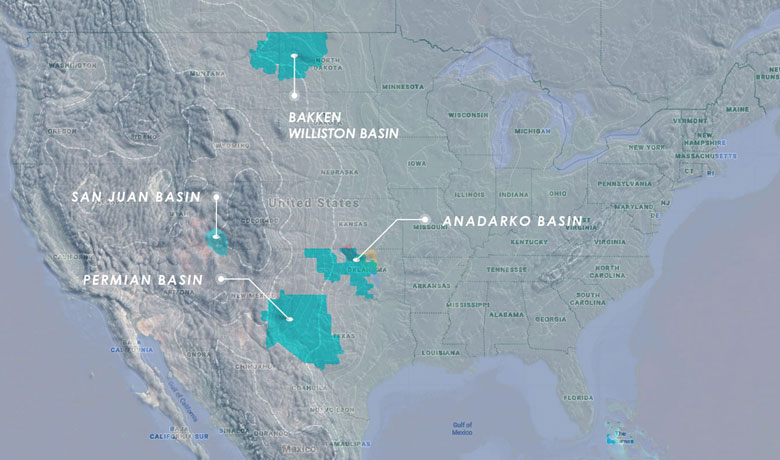

Waveland’s investment activities in the Mid-Continent region of the United States are made alongside some of the industry’s most experienced and respected operators. We use cutting-edge technology to acquire minority equity positions in a diversified portfolio of oil and gas working and mineral interests operated by leading U.S. energy companies and located in the premier, lower-risk geologic basins within the United States. Our partners possess strong geologic assessment abilities, extensive engineering expertise in horizontal well design, drilling and completion, and state-of-the-art fluid management.

Bakken Shale, Williston Basin – North Dakota

Waveland and Three Peaks Resources, LLC, one of Waveland’s long-standing, technical energy management teams, initiated an acquisition strategy to capture minority equity working interests and mineral interests alongside some of the largest oil and gas companies currently operating in the core of the Bakken Shale in the Williston Basin in northwestern North Dakota. These operating companies include Continental Resources, ExxonMobil XTO, Whiting Petroleum, Hess Corporation, and EOG Resources.

Waveland’s Bakken Strategy focuses on the core area of the Bakken. Waveland and Three Peaks believe the Williston Basin has superior reservoir quality and its full-cycle drilling economics are among the best in the United States.

The fundamental positive advancements in the Bakken (low entry costs, increased takeaway capacity, low royalty rates, multi-well pad drilling, and enhanced frac technology) have led to an increase in development activity in the Williston Basin. This increase in development has created an investment opportunity that we believe has significant economic potential.

San Juan Basin – Northwestern New Mexico

We entered the San Juan Basin in 2016 with our Colorado-based operating partner DJR Energy, LP. The San Juan Basin is known as one of the most prolific gas basins in the world. Since 2011, horizontal wells in the San Juan Basin Mancos play have produced over 34 million barrels of oil equivalent. With a footprint of over 350,000 net acres and an inventory of over 1,100 high-value drilling locations, DJR Energy holds the largest acreage position in the core of the oil window. DJR Energy has established a premier position in the San Juan Basin, building upon existing operations and adding reserves via the drill bit. Economic production is achieved at a low breakeven cost, and untapped potential in the Mancos oil system has provided rapid growth utilizing innovative drilling, completion, and production practices. DJR Energy is developing the area’s natural resources efficiently with the community and environmental stewardship in mind. Drilling and producing horizontal Mancos oil wells drive DJR’s daily operations. Activity in the basin is managed by an experienced operational staff from offices in Denver, Colorado and Aztec, New Mexico.

Permian Basin – West Texas

Waveland entered the Permian Basin in December 2012 with the acquisition of approximately 18,000 acres in Scurry County, Texas, targeting the emerging Cline Shale and Mississippian plays. The Cline Shale formation within the Midland Permian Basin is an oil/liquids weighted play that includes several pay zones and may contain significant amounts of recoverable oil. Waveland “leasebanked” this position on behalf of Trail Ridge, and Trail Ridge subsequently secured multi-million dollar commitments from Riverstone Holdings and Trilantic Capital Partners. Then in 2014 and 2015, Trail Ridge acquired 7,000 acres in the “heart” of the Wolfcamp play in the Midland Basin, a project in which Waveland has 7.5% direct working interest.